is pre k tax deductible

Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS. Preschool fees are generally not tax-deductible from a parents taxes.

Pre Tax Vs Roth Contributions What S Best For You Brighton Jones

These programs double as a child care service making the cost eligible.

. The deduction requires a physicians. Preschool and pre-kindergarten programs may qualify for a tax credit for children who are too young to attend school. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction.

If youre wondering whether preschool costs are tax deductible. They may be but the IRS has set out strict requirements. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period.

The credit is limited to a maximum of 3000 per child and 6000 for two or more children in preschool. That doesnt necessarily mean you cant still get some money. But child care expenses for children below the level of kindergarten are deductible if they are enrolled in nursery school.

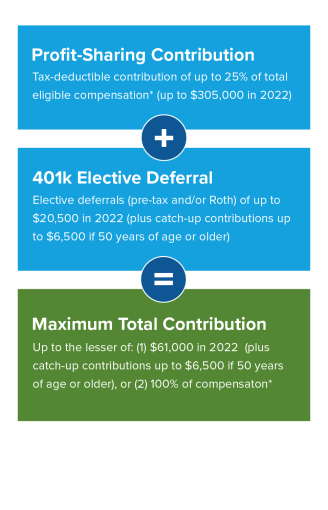

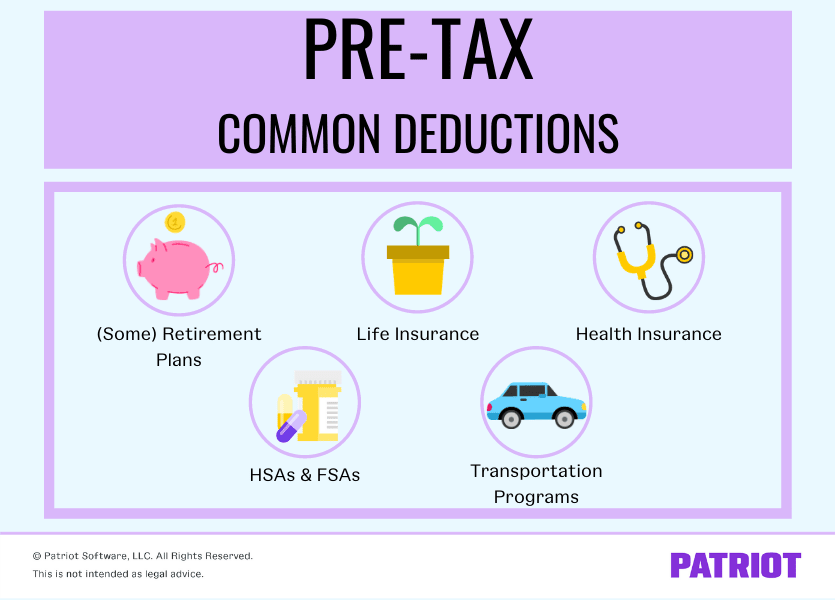

Ordinarily a taxpayer can only confer 16000 a year for. Can pre k tax deductible. A pre-tax deduction is money you remove from an employees wages before you withhold money for taxes lowering their taxable income.

This tax benefit is available for nursery and other pre. First and foremost you should know that preschool tuition isnt technically tax deductible. First subtract the 50 pre-tax withholding from the employees gross.

475 18 votes The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than. Qualified expenses include required tuition and fees books supplies and equipment including computer or peripheral equipment. Is pre k tax deductible Sunday July 10 2022 No tuition for kindergarten isnt a qualifying expense for the child and dependent care credit because expenses to attend.

Is pre k tax deductible sunday july 10 2022 edit. Is preschool tuition tax-deductible. Any type of school payment pre-school elementary middle school or high school is not tax-deductible Rafael Alvarez founder and CEO of ATAX tells Romper.

In addition the credit is limited by the amount of your income and to qualify you. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses.

Since at least if one or both. The end of the tax year is the last day of the calendar. Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense.

What school expenses are tax deductible. If your child is attending a private K-12 school because they have special education needs you may be able to get a tax break on the tuition. Assuming you meet these.

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

The 5 Best Tax Breaks For Parents Forbes Advisor

Nature Preschools Preschool Programs

Why The Federal Government Should Subsidize Childcare And How To Pay For It

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Policy Card Pre K 12 Education Georgetown Public Policy Review

Tax Tips When Sending Kids To Private Or Public Schools Turbotax Tax Tips Videos

The Professional Development Tax Deduction What You Need To Know

California Teacher Shortage Threatens Pre Kindergarten Plan Calmatters

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Is Preschool Tax Deductible Sometimes

What Are Pre Tax Deductions Definition List Example

What Is The Educator Expense Tax Deduction Turbotax Tax Tips Videos

Waterford Org Early Learning Software

Is Preschool Tuition Tax Deductible In 2021 Here S What To Know

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

How To Get A Tax Deduction For Supporting Your Child S School